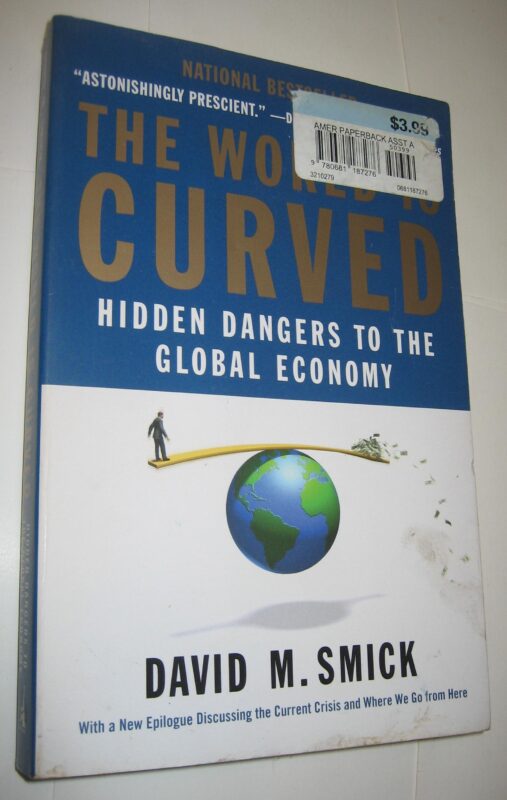

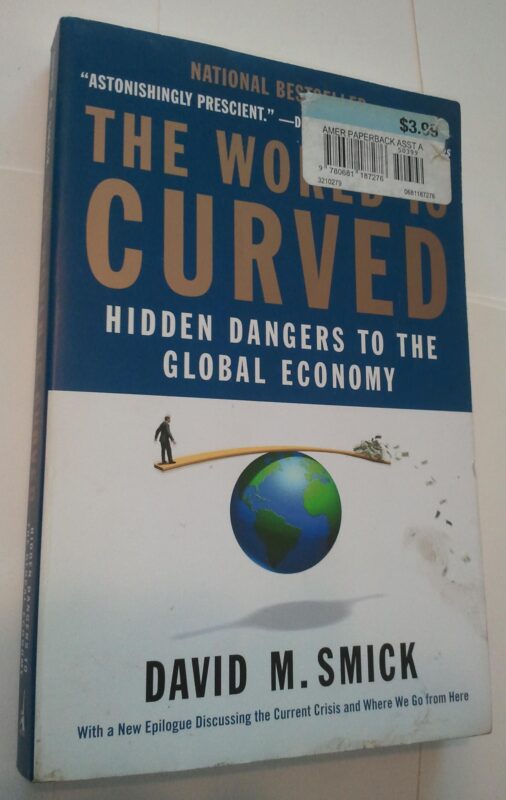

The World is Curved SC Hidden Dangers of Global Economy David M. Smick

$44.99

Description

The World Is Curved: Hidden Dangers to the Global Economy Paperback

by David M. Smick (Author)

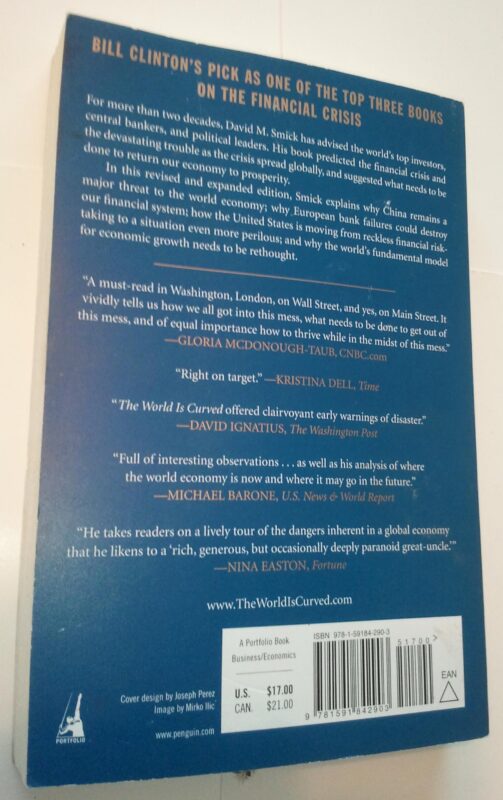

David Smick keeps a low profile, but experts consider him one of the most insightful financial market strategists in the world. For more than two decades, he has conferred with central bankers (such as Alan Greenspan and Ben Bernanke) and advised top Wall Street executives and investors, from George Soros to Michael Steinhardt to Stan Druckenmiller. Political leaders (from Bill Bradley to Jack Kemp) have regularly sought his policy advice.

The World Is Curved picks up where Thomas Friedman’s The World Is Flat left off, taking readers on an insider’s tour through the private offices of central bankers, finance ministers, even prime ministers. Smick reveals how today’s risky environment came to be—and why the mortgage mess is a symptom of potentially far more devastating trouble. He wrestles with the two questions on everyone’s mind: How bad could things really get in today’s volatile economy? And what can we do about it?

Drawing on riveting anecdotes in language anyone can understand, Smick explains:

– How greed-driven bankers and investment bankers have put everyone’s pensions and 401(k)s at risk

– Why today’s “incredible shrinking central banks” may not be able to save us when the next crisis hits

– Why the big-money Russian, Chinese, Saudi, and Dubai sovereign wealth funds represent a tectonic shift in global financial power, away from the United States, Europe, and Japan

– Why the world desperately needs a “big think” financial doctrine to guide today’s dangerous ocean of money

The World Is Curved is the rare book that speaks simultaneously to the Wall Street, Washington, and London elite, yet its apt storytelling shows Main Street readers how to survive in these turbulent times.

With this illuminating book, Smick revisits Thomas Friedman’s description of the “flat” world produced by globalization, arguing instead that the uncertainty produced by globalized financial markets has created a world that is curved, where events and their consequences are unpredictable. Smick begins with a puzzle: why did the subprime mortgage crisis, an event that directly impacted a relatively small piece of the global market, have such a catastrophic impact on the world market as a whole? From there, the author turns to topics as complex and varied as the potential 21st Century Chinese financial bubble and the policy dilemmas currently facing the Fed. Throughout the book, the author returns to the argument that political trends are increasingly at odds with the forces driving the globalized world economy. Smick brings expertise and lucidity to many difficult subjects, and while his book’s appeal will likely be limited to those with some background in the field, it will undoubtedly stir interest and debate amongst investors, policymakers and strategists alike.

The 2007–08 subprime financial crisis is the jumping-off point for Smick’s (Johnson Smick International) examination of current threats to global prosperity. He explains that although the subprime losses are small in the context of world financial markets, a lack of transparency has diminished investor confidence, dried up financial liquidity, and threatened the very foundations of our world financial system. He says that the growth of global financial markets has made it more difficult for central banks like the U.S. Federal Reserve to intercede effectively in times of crisis. Smick compares the subprime crisis to past events like the UK’s forced devaluation of the pound in 1992 and Japan’s economic stagnation in the 1990s. He warns of pending dangers like an overheating of the Chinese development juggernaut and the present calls for protectionism by U.S. politicians. He favors a global financial system built on transparency and trust. Smick’s role for some 30 years as an economic adviser to central bankers and legislators of all stripes gives him a solid perspective on the global financial system. This summing-up of the subprime debacle and other global financial threats, aimed at general readers, is first rate; highly recommended for all public and academic libraries.

Paperback: 336 pages

Publisher: Portfolio

This extremely well-written book describes the current financial problems of globalization. It is easy to follow, easy to understand, and eliminates jargon. It’s a great example of communication out of the Frank Lutz ‘words that work’ school.

The problems of globalization, as the book described’ are critical as a major period of entrepreneurial prosperity may be coming to an end. The availability of `oceans of money’ started with a liberalized program in the USA during the early 1980’s and later elsewhere with the rejuvenation of pension funds and other financial instruments. Capitalization/reserve requirements of banks were reduced, capital gains taxes were cut and a variety of new investment vehicles freed up large sources of capital. Smaller businesses were funded as the need to invest capital continued to grow and consequently, new wealth, new jobs and prosperity resulted. Moreover, many countries established sovereign funds that needed to be invested too. Rapid machine computation facilitated an explosion of capital transfer and global investment. Because the USA was perceived as the safest haven with the highest level of global transparency, it benefited from these changes. Moreover, the USA with labor market flexibility, higher education, a benign political environment, innovative strategies and quality of corporate management is considered the prime country in which global funds invest. However, the USA is not an island, but is interconnected and therefore subject to global economic events. But is it fading?

The downside was securitization, a process of spreading out investment into multiple income streams to reduce risks. Securitization also involves arcane practices that are difficult for most policy makers, bankers and financial institutions to fully understand. In the process are no longer tied to the risk of the borrower, making capital easier to lend. Even riskier is the overlay of lack of transparency in many countries, including China. Eventually, underpriced and hidden risk will lead to major market corrections, as we have seen recently. Moreover, global forces and lower international trade barriers have diminished the role of government to influence their own economies.

We now see increasing political risk in the USA that may kill the goose that laid the golden egg. The rising tendency of anti-global trade pacts, envy, class warfare, and populism, are placing the US at economic risk. American politicians, according to Smick, have only one option and that is to make the American economy the most attractive destination for global investment on a LONG-TERM basis.

The wild card in all of this is China and I cannot detail the intricacies in Smick’s chapter. China’s approach includes widespread investment for strategic advantage, and a lack of transparency. Also it is involved in widespread commodity stockpiling. There, foreign investment is controlled. Chinese banking does not understand credit risks and are viewed instead as social and political instruments. In short, their economic system is extremely unstable and a bursting of its bubble will have worldwide cascading consequences

The chapter on Japan’s economic activities is well worth reading, as is the chapter on the sterling crisis of 1992.

But perhaps the biggest change during the past 25 years is the diminishing role of central banks. As private entrepreneurs and government sovereign funds accumulate large amounts of cash, the role of central banks has diminished. With diminished governmental roles, people’s vulnerabilities are increasing and one of the consequences is political pandering in the form of abetting class warfare,. We see it today. That is the underlying cause of the current backing-off by congressional democrats from free trade. It is a disaster in the making

The closing chapter on “Surviving and prospering in this age of volatility” would require a long review in itself. It is not only worth reading, but needs to be reread to fully comprehend the economic mess we are in today and possible solutions out of that mess.

Sticker on cover. Stains on cover. Otherwise near mint condition. 978-1-59184-290-3.

978-1-59184-290-3

Sticker on cover. Stains on cover. Otherwise near mint condition.

Related products

-

Norton Anthology American Literature 7th Edition SC Edgar Allan Poe Herman Melville

$49.99 Add to cart -

Panorama 3rd Edition Workbook/Video Manual SC Introduction to Spanish Language Blanco Donley

$49.99 Add to cart -

Generalissimo el Busho Essays & Cartoons on the Bush Years SC Ted Rall NBM Publishing

$39.99 Add to cart -

Wake Up You’re a Liberal SC Ted Rall How To Take America Back

$49.99 Add to cart