The Atlas of Economic Indicators SC Visual Guide to Market Forces and Federal Reserve Carnes

$29.99

Description

The Atlas of Economic Indicators: A Visual Guide to Market Forces, and the Federal Reserve Paperback

by W. Stansbury Carnes (Author), Stephen D. Slifer (Author)

For professional and individual investors, executives or business students, a unique atlas of what makes the markets move.

“A very useful guide for understanding the investment impact from economic information released almost daily. Every investor needs to know what this book says.”–Donald Ratajczak, Economic Forecasting Center, Georgia State University

Paperback: 240 pages

Publisher: HarperBus

This book is an easy read and it is a great introduction to economic indicators. It gives a description of what each indicator actually measures, who produces the indicator, and why it is important to the stock, bond, and currency markets.

It is a very quick read (less than a day) and can be used to refresh one’s memory on the basic econ indicators.

It also includes an in-depth discussion of how the Fed actually regulates the money supply. This is one of the better introductions to the Fed’s operations that I have read.

I recommend quickly reading this book whenever you need a refresher course on the very basics of what to look for in economic indicators, especially with respect to how they affect the markets.

Being in the finance WS circle (directly or by way of being in the North East MBA corridor), this book is one often referred to as the companion guide to make sense of financial institutions, their interdependence with the real sector and the Fed and because it gives meaning to otherwise stale macroeconomic courses.

Let me put it to you like this: If you read Bernanke/Abel’s Macroeconomics book and you read this Atlas of Economic Indicators as if it were its companion, it would be nearly as if you had sat down in class with Jeremy Siegel at the Wharton School.

So, because of the aforementioned, I feel compelled to mention that the book does assume you know some key valuation concepts (like valuation of fixed income or valuation of enterprises) which are critical to know beforehand. Without these concepts, you reading this book would be a borderline futile exercise.

One last thing, the synthesis without the loss of precision of this book (in spite of its old publishing date) make this book every bit relevant today as when it was originally published. For the resourceful ones, you would simply need to update yourself on the deltas that have taken place in the respective bureaus of statistics.. and that information you can find in newer (but less powerful) books currently in circulation.

Rounding to bottom right pages. Yellowing to pages. 0-88730-537-7.

AMSCO’S Preparing for the Regents Examination Mathematics B Answer Key SC

Near mint condition.

Near mint condition.Near mint condition.

Related products

-

Panorama 3rd Edition Workbook/Video Manual SC Introduction to Spanish Language Blanco Donley

$49.99 Add to cart -

5 Steps to a 5: AP U.S. Government & Politics 2012-2013 SC Pamela K Lamb Mcgraw Hill

$39.99 Add to cart -

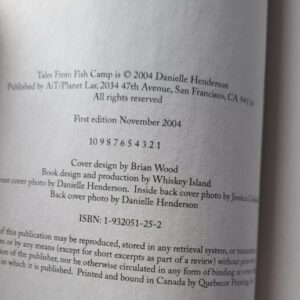

Tales From The Fish Camp TP NM OOP Danielle Henderson

$69.99 Add to cart -

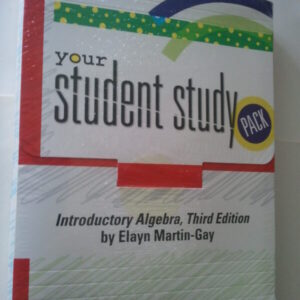

Your Student Study Pack: Introductory Alegebra 3rd Edition Elayn Martin-Gay SEALED

$99.99 Add to cart